The New Federal Reserve Chair and His Conflicting Ideals

My concerns around the nomination and they’re probably not what you think.

Thank you for reading our work! Nominal News is an email newsletter read by over 4,000 readers that focuses on the application of economic research to current issues. Subscribe for free to stay-up-to-date with Nominal News directly in your inbox:

What Happened?

On January 30, 2026, US President Donald Trump picked Kevin Warsh to replace Jerome Powell on May 15, 2026 as the Chair of the Federal Reserve.

Why Does It Matter?

The Federal Reserve (the US Central Bank) sets US monetary policy. Unlike other central banks, the Federal Reserve has a dual mandate:

Maintaining price stability by keeping inflation stable (typically at 2%);

Maximizing employment.

Decisions made by the Federal Reserve, therefore, influence inflation and employment. These monetary policy decisions are made via a vote in the Federal Open Market Committee (FOMC). There are 12 voting members in the Federal Reserve:

7 Federal Reserve Governors (of which the Chair is one);

The head of the New York Federal Reserve;

4 rotating presidents of the regional Federal Reserve Banks (there are 11 such banks).

The Chair of the Federal Reserve has one vote like all other voting members.

Why Are We Writing About This?

Independence Concerns

The reason this nomination garnered more media attention than usual is due to comments from President Trump about wanting lower interest rates. These comments have raised concerns that the Federal Reserve may no longer act independently of the government, which may result in economic instability.

Monetary policy, as mentioned above, influences both inflation and employment – high interest rates, which lower inflation, also slow down economic activity, which increase unemployment. This can naturally create a problem for the government – a slow, high-unemployment economy can reduce the chance of winning an election. That is why monetary policy is often not controlled directly by the governments, as governments may be tempted to protect their electoral position by keeping interest rates lower. This, however, can result in runaway inflation, due to the ‘unanchoring of inflation expectations’.

‘Inflation expectations’ is one of the three key drivers of inflation (if you’d like to learn more, we have a guide on inflation here). In simple terms, what people and firms believe inflation will be in the future impacts today’s inflation. Thus, if people believe that the Federal Reserve will no longer focus on keeping inflation stable in the future, then today’s inflation will rise. Restoring the ‘anchor’ can take many years, as you need people to credibly believe that the Federal Reserve will prioritize keeping inflation in check. (Somewhat worryingly, here is an observation by Thomas L. Hutcheson that inflation expectations may already be trending higher).

Should We Be Concerned?

I personally don’t think that inflation expectations will un-anchor. Monetary policy is voted on by 12 voters and thus, it is unlikely that a majority of these voters would go against what economics would broadly suggest (i.e. allow for inflation expectation to un-anchor). Moreover, although Warsh has stated that he would prefer to lower interest rates today which could increase the already high inflation of 3%, some of his other monetary policy preferences would lead to lower inflation. Let me explain.

Kevin Warsh’s Thoughts and Preferences

In one article (“The Federal Reserve’s Broken Leadership”), Warsh argues against the ‘large’ Federal Reserve balance sheet and would prefer to shrink it (commonly referred to as “Quantitative Tightening”). This is actually a disinflationary policy.

An Aside on Federal Reserve Balance Sheet Operations

The Federal Reserve holds assets – predominantly US Treasuries (government bonds) and Mortgage Backed Securities (home loans). The reason the Federal Reserve holds these assets is to increase the amount of ‘liquidity’ in the financial system, as well as lower the interest rate that needs to be paid on long-dated borrowing (especially home loans).

To understand how this happens, let’s think of a home loan. Initially, a bank issues a loan to a home buyer. The bank now owns an asset – the loan – which pays interest and principal in regular installments. However, the bank is ‘stuck’ with this asset, as it only slowly gets the money from the home buyer.

In comes the Federal Reserve, which can buy this home loan from the bank. The bank instantly receives all the cash and can re-lend this money, stimulating the economy. The Federal Reserve now holds the asset (the home loan) and slowly gets paid back. Since the bank knows that the Federal Reserve will be committing to buying the home loan, the bank can also offer a lower interest rate on future home purchasers. In this way, the Federal Reserve can both increase liquidity in the market (the bank now has cash it can lend again) and also reduce the long term interest rates (home loans have lower interest rates).

Reducing the Balance Sheet

Turning back to Warsh’s article, he stated a preference of reducing the Federal Reserve balance sheet, which would entail selling off the assets that the Federal Reserve has. This will have a disinflationary effect, as it would do the opposite of buying assets – increasing borrowing costs and reducing the amount of cash in the market.

So it appears Warsh prefers two policies – lowering interest rates and reducing the balance sheet – that work in the opposite directions, meaning inflation is unlikely to un-anchor.

What Does Concern Me

Although I am not concerned about inflation spiralling out of control, I am a bit concerned by the approach Warsh has towards analyzing certain economic events. Here are a few examples:

On AI

Warsh believes “AI will be a significant disinflationary force, increasing productivity and bolstering American competitiveness.” This is a strong and risky belief, as evidence for it is very minimal. Warsh predicts a 1 percentage point higher productivity growth, which is nearly doubling the long run productivity growth of 1.5%. Again, this appears to be very unlikely and more wishful than academically rigorous.

On Recent Inflation

“Second, inflation is a choice, and the Fed’s track record under Chair Jerome Powell is one of unwise choices. The Fed should re-examine its great mistakes that led to the great inflation”.

Warsh puts blame squarely on the Federal Reserve for high inflation. However, as we have discussed before, keeping inflation at 2% at all costs during the pandemic would have ended up severely harming workers. The Federal Reserve followed the latest research in not increasing interest rates by as much. Its action during the Covid pandemic resulted in large real wage growth for many workers, especially on the lower end of the income distribution. At the time, the choice for the Federal Reserve was either higher than usual inflation or large unemployment, and they wisely chose the first.

On Tariffs and Inflation

In this op-ed, Warsh states “So long as Mr. Powell’s Fed hasn’t suffered from a loss of inflation-fighting credibility, the effect of a 10% tariff [on inflation] shouldn’t be statistically significant.”

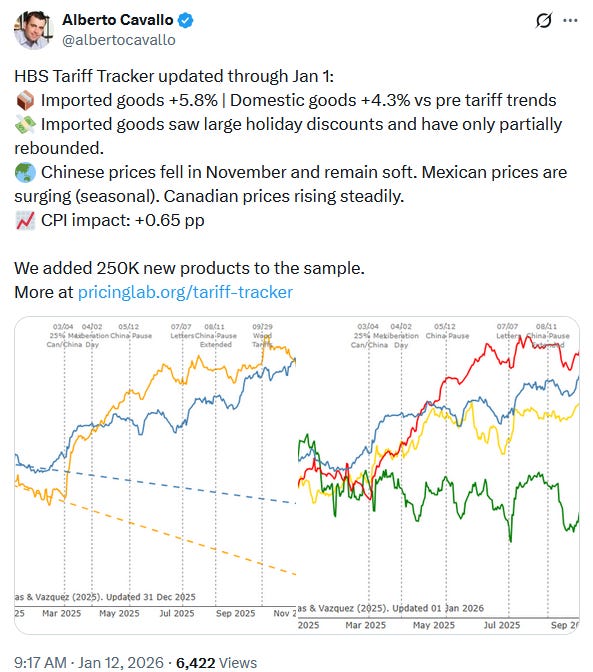

This is a surprising statement, as we know today that the tariffs have led to at least 0.65% extra inflation:

Tariffs do lead to higher inflation, as we discussed here.1 Tariffs (and potentially current immigration policy) are some of the main reasons we are at 3% inflation today rather than 2% inflation.

Concluding Remarks

Overall, I don’t have any strong concerns on Warsh, as ultimately the Federal Reserve Chair is just one vote in a committee of 12. My main concerns surround how he appears to view certain economic developments through one perspective without looking at all the data, with the tariff example being especially relevant. This dogmatic view of economic events may put him in an interesting spot, where his preferred policy will not be chosen by the FOMC (the interest rate voting committee), leading to some very awkward press conferences.

Tell me in the comments what do you think of the appointment of Warsh. Am I being too harsh on him? Or am I not concerned enough?

If you would like to support us in reaching our subscriber goal of 7,000 subscribers, please consider sharing this article and pressing the like❤️ button at top or bottom of this article!

Interesting Reads from the Week

Article – The Means-Testing Industrial Complex: Luke Farrell shows how means-testing programs (such as work requirements) end up costing the government a significant amount of money.

Article – Young College Graduate Unemployment Is Worse Than the Slowdown Explains: Mike Konczal explains that there may be truth to the fact that this slowdown might be worse for young college grads than previous ones.

Note: An interesting debate on X/Twitter, where Oliver Blanchard suggested that people in France prefer more leisure to Americans. This ended up with a discussion – do the French prefer more leisure or are they prevented from working more by laws/regulations?

The Federal Reserve could prevent inflation from rising under tariffs by raising interest rates, which would result in a significant rise in unemployment. This would not be an optimal decision.

Appreciate the nuanced take on Warsh's contradictory policy stances. The part about him wanting both lower rates and quantitative tightening is telling, they kinda cancel each other out on the inflation front. His claim that AI will boost productivity by 1 percentage point seems way too optimistic given current data, feels more like hopeful projection than rigorous analysis ofwhere we actually are.

Warsh states “So long as Mr. Powell’s Fed hasn’t suffered from a loss of inflation-fighting credibility, the effect of a 10% tariff [on inflation] shouldn’t be statistically significant.”

Again, half right. The effect of tariffs on infltion run _through_ the Fed. The Fed has to decide how much additional inflation (beyond what it woud have chosen w/o the tariffs) it should inflate to facilitate the adjustment of relative prices to the increase in tariffs on a wide rance of imported goods. "Not signiicant" is a policy judgement.