Recession Talk

There's been a lot of chatter about recession lately. Why is there so much focus on it, when the economy is actually growing.

A small update from Nominal News: we have recently changed the webiste url to nominalnews.com! We are still on Substack, but now you can find us directly by going to nominalnews.com.

Thank you for reading our work! If you haven’t yet subscribed, please subscribe below:

If you would like to support us further, please consider sharing and liking this article!

Introduction

There has been a significant pick up in recession talk. The Federal Reserve staff forecasts suggest that there will be a recession occurring this calendar year. However, a lot of recent data, such as the unemployment rate at 3.4%, shows that we are nowhere near a recession yet. Moreover, US Gross Domestic Product ("GDP") grew in the first quarter and in the most recent estimates by the Atlanta Federal Reserve, GDP is expected to grow in the second quarter by almost 3% annualized.

But why are so many people talking about recession and feeling as if they are in a recession?

Recession Announcements

In the US, recessions are announced by the National Bureau of Economic Research (NBER). A recession is announced based on a definition that “involves a significant decline in economic activity that is spread across the economy and lasts more than a few months”. The NBER staff focuses on the depth (how big of an economic contraction occurs), duration (for how long economic activity is subdued) and diffusion (how much of the economy is observing a reduction in economic activity).

Typically the duration is considered to be two quarters of economic contraction. Diffusion typically also looks at whether the economic contraction has impacted unemployment and overall payroll amounts. For example, the economic contraction that occurred for two quarters in 2021 was not called a recession because there weren’t any employment impacts on the economy. Lastly, depth depends on how large the economic contraction is. Recently, the drop in economic activity in March 2020 due to the coronavirus pandemic was deemed to be a recession, even though the economic contraction lasted for only a quarter (in the second quarter of 2020, GDP dropped by an annualized rate of 33%) .

It is also worth noting that recessions are typically backdated. The start of the recession is announced by NBER after the recession has already started. Therefore, we can be in a recession before it is officially stated. This somewhat explains why the media and media personalities try to predict recessions before they happen.

Recession Predicting

Inverted Yield Curve

Many articles often mention the ‘inverted yield curve’ as a sign of an incoming recession. Why? Let’s explain what an inverted yield curve is. First, what are yields? A yield is the rate of return an investor expects to receive from a financial instrument. Typically, the financial instrument is a bond. A 3% yield means the bond would give you a 3% return per year, until the last year when the bond is fully repaid by the issuer. US Treasuries are bonds issued by the US government. US Treasuries are issued at differing maturities (i.e. in how many years till the US treasury is repaid). Treasuries with longer maturities are typically riskier since there is a higher probability the government will not fully repay the amount they owe. Since these Treasuries are riskier, investors would expect a higher return. Therefore, if we take the yields (the rate of return) of Treasuries at different maturities and graph these values, we would get the yield curve for US Treasuries.

Typically, this yield curve is an increasing line – at longer maturities, investors expect a higher rate of interest. This is the normal yield curve. An inverted yield curve occurs when the rate of return demanded by investors is higher for short term maturities (2 years) than for longer term maturities (10 years). How does this happen? The reason this ‘inversion’ occurs is due to the fact that interest rates are expected to go down in the future (the current rate is 5.25% and it is expected to drop to 3.25% by 2025). The yield of Treasuries (and any bond) is closely linked to the interest rate. Investors expect a rate of return above the interest rate depending on the risk level of the bond. Since US Treasuries are considered to be one of the safest assets (lowest risk), their rate of return is very close to the interest rate set by the Federal Reserve. As interest rates are expected to be lower in the future (the next 10 years), the rate of return on longer term Treasuries is lower than of the shorter term Treasuries.

Why are falling interest rates linked to recession? If a Central Bank lowers interest rates, this action stimulates economic activity. With lower interest rates, it is cheaper to borrow and therefore cheaper to open or expand businesses. Therefore, Central Banks will lower interest rates if economic activity slows down, which occurs during recessions. Therefore, an inverted yield curve may suggest that a recession will occur soon.

It is worth noting that the inverted yield curve does not cause a recession. An inverted yield curve is simply what market participants believe will occur in the future. Since the 1960s, the inverted yield curve has successfully predicted nearly every recession. The chart below shows the difference between the yield of a 10-year US Treasury and the yield of a 2-year US Treasury. When it goes negative, the yield curve inverts. The shaded areas are recessions:

The inverted yield curve has however had one false positive – it ‘predicted’ a recession in the 60s that did not occur. Moreover, recently the inverted yield curve failed to ‘predict’ a recession for the first time – the pandemic related recession in 2020, as can be seen in the chart below.

The inverted yield curve also does not tell us when the recession will occur. It can typically be anywhere from 7 to 24 months after the inversion. Currently, the yield curve is inverted and has been since July 2022, but there have been no signs of recession.

Sahm Rule

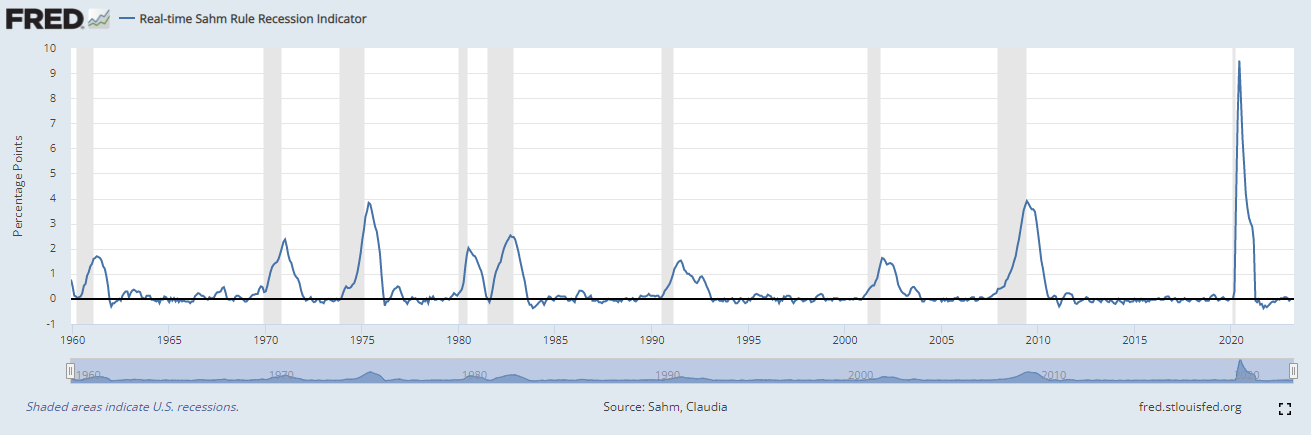

Since the inverted yield curve does not effectively tell us whether we are in a recession, economists have looked at developing new measures of whether we are in a recession. One such measure was developed by a Federal Reserve economist – Claudia Sahm (also a writer on Substack!). The Sahm rule looks at relative changes in the unemployment rate. If the unemployment rate goes up by more than 0.5 percentage points relative to its 12 month low, then a recession is occurring currently. The benefit of this approach is that it informs us whether we are currently in a recession, allowing the government to quickly respond to stabilize the economy if needed.

The chart below shows the Sahm rule indicator, which is the change in unemployment rate relative to its 12 month low. The darkened areas are recession periods.

As can be seen, the Sahm rule has effectively called most recessions and not shown any false positives. Currently, the Sahm measure does not state that the US is in a recession.

National or Local Recession

Recession is always discussed from a national lens. Is the US (or another country) in a recession? But does that make sense?

The US is a very large country. If California or Texas were its own separate country, they would be the 5th and 9th largest economies in the world. We would then be asking if California or Texas are in a recession. Interestingly, based on the Sahm rule above, California is in a recession, as their unemployment rate has jumped from 3.83% in August 2022 to 4.43% today.

However, at the end of the day, what matters to most people is how they are doing economically on an individual basis. If a person gets laid off or sees real income declines, whether the economy is in a recession is not as important to them – they might be personally experiencing a recession, as their incomes are falling.

The total income of all individuals is a good proxy for GDP. Thus, when total income falls, this could be seen as a recession. But there is a lot of variety in how incomes at different levels behave.

The US is highly unequal. The top 20% of highest income earners account for nearly 50% of total income generated in the US. Therefore, if the top 20% sees an increase in incomes by 2%, the bottom 80% could see no increase and even a decline in incomes, and the US would not be in a recession. But in reality, 80% of individuals are worse off. And data demonstrates this:

Real incomes for low income individuals barely increased, and even fell, during the 2000s and 2010s. These individuals experienced recessions.

The above is intended to highlight that the term recession is insufficient to judge the health of the economy. In times of large growth, income is not distributed equally and many individuals might actually be worse off. One can ask – why shouldn't the situation where a majority of people are worse off be called a recession? This is a subjective question from the perspective of economics and there is not much resulting research as it depends on the welfare function society aims to maximize. The welfare function determines how we assess the welfare of each individual – whose welfare (e.g. low income vs high income) is more important?

Post Pandemic Recovery

This leads us to today. Many news articles and media personalities talk about the incoming recession. However, recent research by Autor, Dube and McGrew (2023) has highlighted an interesting situation – the post pandemic recovery has significantly benefited low income individuals in real terms. Low income individuals witnessed growth in real wages, while middle and top income individuals saw a reduction in their real hourly wage.

The situation has actually eliminated part of the 'college premium' – the wage gap between individuals with a college degree and individuals without one. Moreover, unemployment levels are at all time lows. Unemployment has especially fallen for minorities which has also reduced the income disparities by race.

The post-pandemic recovery has been very positive for many low income individuals.

Conclusion

Now we can address the initial question – why there is so much talk about recession and how can everyone be right.

Based on the income data above, along with anecdotal evidence of larger tech sector layoffs, media layoffs, consulting layoffs, it appears that only certain sectors of the economy might be experiencing a slow down or even recession. This has so far predominantly impacted white collar workers. Now, most media is tailored towards the white collar, professional class. Given that, it is no surprise that their readers might be experiencing a recession and so the news outlets and opinion makers will focus on that issue. Thus, the higher income individuals might be experiencing a recession while lower income individuals are witnessing a boom.

In this way, both statements can be seen as 'right'. The issue is perspective. Each individual cares about their own outcome rather than the whole economy. If an individual is doing worse, then in their life, there is a recession. On a slightly larger scale, if communities or cities are not doing well, they might be experiencing a recession even if the rest of the country isn't. This highlights the importance of looking at more granular data and analyzing how income is distributed to determine how economic growth or contraction impacts everyone.

Cover photo by Cottonbro Studio.

If you enjoyed this article, you may also enjoy the following ones:

Correcting Economic Understanding of US Senators – during the Senate hearing with Federal Reserve Chairman Jerome Powell, several Senators made questionable economic statements.

High Profile Layoffs – how the recent layoffs in the tech sector will affect the wider economy.

To Compete or Non-Compete – why non-compete clauses do not solve any issues, but only create costs.