Correcting Economic Understanding of US Senators

Economics is a field that has many moving parts that impact each other in not obvious ways. Sometimes oversimplifying some concepts can lead to potentially erroneous conclusions.

Introduction

On March 7, Federal Reserve Chairman Jerome Powell spoke to the Senate Committee on Banking, Housing, and Urban Affairs during his Semiannual Monetary Policy Report to Congress. During the hearing, senators were able to ask Jerome Powell questions, focusing on the interest rate policy of the Federal Reserve and banking regulations. Having listened to the hearing, we noted that quite a few of the questions had incorrect economic foundations. Some of these questions made national news and were hotly debated in the media and social media. Below, we will outline a few of the questions and statements made by the Senators, and elaborate on the issues with the Senators’ economic reasoning.

As we do not have access to a full transcript, we will link to the time markers of the official recording of the hearing that can be found here.

External Validity and Extrapolation

Statement (1:04:23): Senator John Kennedy cites a study, which found that based on historical instances of inflation coming down by 2 percentage points, unemployment had to go up by 3.6 percentage points. Since inflation is currently 6.4% and unemployment is 3.4%, Senator Kennedy then claims that to bring down inflation to 4.4% (a decrease of 2 percentage points), unemployment would need to go up to 7% (an increase of 3.6 percentage points). To bring down inflation to the 2% target, unemployment would have to be above 10%.

Explanation: There are two issues with this analysis: 'external validity’ and ‘extrapolation’. External validity refers to the issue of whether findings on one particular group or historical event can be taken out of that particular context and used in a new setting. For example, a policy that might work in one country, might be ineffective in another country. Another example, which is more current, is the impact of student loan forgiveness – studies have shown that student loan forgiveness for low income individuals will benefit the economy. However, since the studies only looked at low income individuals, it does not mean that the same effect will be seen with high income individuals. External validity is a problem that plagues nearly all empirical analysis. In the context of Senator John Kennedy’s statement, the historical examples might not apply to the current situation due to fundamental differences in the conditions and nature of the economy.

Furthermore, Senator John Kennedy extrapolated the results by assuming that in order to bring down inflation by 4 percentage points, we would need to increase unemployment by 7.2 percentage points. Extrapolations occur when we take the result of a study outside of the range of values of the study. For example, if an experiment would show that 1 extra hour of studying increases exam performance by 2%, it does not mean that studying 5 extra hours would result in a 10% increase in exam scores. In our context, even if we were to assume that the study is externally valid and applicable to the current situation, the result would only apply around the levels of inflation and unemployment that were studied. Realistically, based on macroeconomic models, if unemployment were to actually go up as high as 7% in a short period of time, there would be significantly larger negative pressures on inflation than what Senator Kennedy estimated, with deflation becoming a danger. For reference, over the past decade, inflation was around the 2% target, while unemployment rates were in the 4-5% range.

Measurement Issues and Stocks vs Flows

Statement (1:28:13): Senator Elizabeth Warren stated that based on the Federal Reserve’s projection, unemployment will go up to 4.6% by the end of the year if the Federal Reserve continues its current interest rate trajectory. This would result in approximately 2mln extra unemployed. Senator Elizabeth Warren then asked Jerome Powell what he would say to those additional 2mln unemployed.

Explanation: This statement made headlines in the US. Similar to the above statement, there are two issues. The first issue is misrepresenting what the unemployment rate actually captures. The unemployment measure, provided by the Bureau of Labor Statistics in the US, is defined as the number of people looking for a job that are not currently employed divided by the number of people in the labor force. By labor force, we are not referring to all adults capable of working, but to all adults who want to work. People that are not actively seeking a job fall into the “out of the labor force” category and are not measured in unemployment statistics. A typical example of an out of labor force person is a university student – since they are in college, they are not seeking out a job, so it would not make sense to consider them as unemployed. There are many reasons some people choose to not be in the labor force – some reasons can be seen as ‘good’ (personal preference), but some can be seen as ‘bad’. An example of a ‘bad’ reason is that if someone has been out of work for a long time, they might give up and stop trying to find a job. They drop out of the labor force and are not counted as unemployed, even though in reality they would have preferred to have a job.

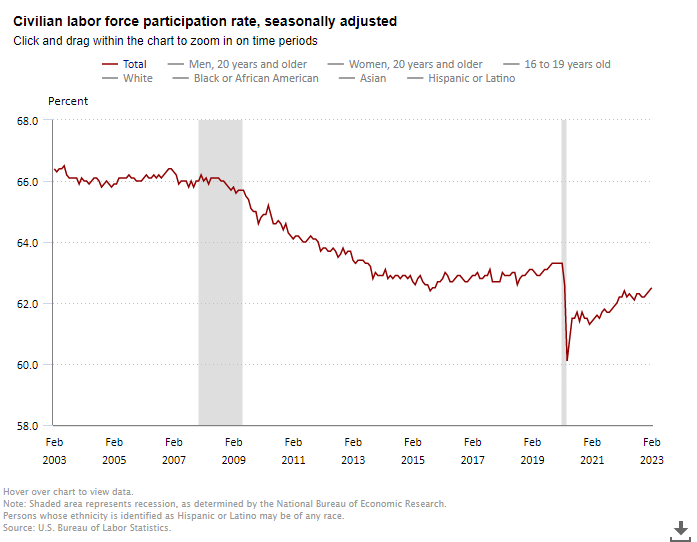

The US labor force participation rate, which measures the percentage of adults that are in the labor force (either employed or looking for a job) has been steadily declining in the last decade, based on data from the Bureau of Labor Statistics. This fact can make unemployment look lower than it actually is. Numerically, suppose you have 5 people – 3 employed, 1 unemployed and 1 ‘out of the labor force’. The unemployment rate is 25%, as there are 4 people that are in the labor force and 1 is unemployed. If the ‘out of the labor force’ individual returns to the labor force, they would start off unemployed, resulting in an unemployment rate of 40% (2 unemployed and 5 in the labor force).

Therefore, unemployment in the US can rise, as Senator Elizabeth Warren pointed out, but not because the currently employed are getting laid off, but because people are returning to the labor force. There is already evidence of this happening – during the most recent US jobs report, the number of new jobs created far surpassed expectations at 311,000, while unemployment ticked up from 3.4% to 3.6%! This was because the labor force participation rate went up. Thus, just focusing on the unemployment rate may not necessarily be meaningful as it does not paint a full picture of the labor situation.

The second issue with Senator Elizabeth Warren’s statement is implying that the 2mln unemployed are a fixed group of people. The unemployed are an extremely fluid group of people. The actual number of unemployed depends on the job destruction rate (how many people become unemployed) and the job finding rate (how many people become employed). The stock of unemployed people (i.e. the number of unemployed at any given point in time) depends on the values of these rates. Higher interest rates can alter both the job destruction rate and job finding rate. Regarding the job finding rate, the median duration of unemployment in the US is around 8 to 9 weeks currently. That means 50% of the unemployed find a job within 2 months. This rate of finding jobs is much higher than in other countries. A newly unemployed person would not expect to be unemployed for too long of a period.

The main concern from the perspective of a labor force participant is not whether they are necessarily employed or not, but what is the value of their total lifetime earnings measured in real terms (adjusted for inflation). Currently, real wages are falling. A policy that results in higher real wages, but increased probability of unemployment (due to a lower job finding rate or a higher job destruction rate), might be preferable to the current situation with low unemployment and negative real wage growth. Therefore, claiming that in the current economic situation with high inflation, increasing unemployment will definitely leave people worse off is not necessarily true, even if it sounds counter-intuitive. It will depend on what happens to real wages.

The main concerns from a macroeconomic perspective of changes in the job finding and destruction rates are the loss of human capital1 upon layoffs and becoming a long term unemployed person (longer than 27 weeks without a job). Regarding the drop in human capital, which we covered previously in the context of the ‘tech’ sector layoffs, there would not be much of an impact, as the newly unemployed find jobs pretty quickly, and thus human capital loss is minimal. Becoming long-term unemployed, however, is a concern, as there is evidence that just the fact that a person is long-term unemployed makes it far more difficult for them to gain employment regardless of their ability or any other skill-related factors (Abraham et al., 2022). Below is a graph showing the probability of finding a job given the duration of unemployment.

Interest Rates and Housing Affordability

Statement (2:25:10): Senator Raphael Warnock, but also Senator Catherine Cortez Masto and Senator Kyrsten Sinema, among others, stated that the current high interest rate environment has made housing unaffordable to many, because mortgage rates have increased significantly.

Explanation: The cost of purchasing a home involves more than just the interest rate. The components that impact the affordability of home are its price, the interest rate on the mortgage, and the needed mortgage amount. Additional elements that are less impactful are the property tax on the home, which depends on the price, as well as home insurance. Thus, when talking about affordability, it is important to take all these factors into account. Generally, the amount you have to pay a month for a home is the loan amount times the interest rate and the mandatory principal repayment. Therefore, whether the principal is lower with a higher interest rate, or the principal is higher with a lower interest rate, the individual buying the house will be indifferent between these two alternatives. What matters to them is how much they will have to pay per month. The recent low interest rates and Covid pandemic have significantly increased prices of homes in the US. Redfin data on median house prices shows that below:

Lower interest rates allowed people to take out larger mortgages, which in turn allowed property owners to sell homes at higher prices. At higher interest rates, larger mortgages will not be possible, which will force property owners to reduce prices. This trend has already started, and median prices have fallen by 10% from their 2022 peak. Lower house prices also allow individuals to put in a larger down payment than before, further reducing monthly costs.

To illustrate this, here is a simple calculation using a mortgage calculator with the following assumptions:

Option 1: $400,000 house price with an $80,000 down payment at a 3.5% interest rate for 30 years

Option 2: $360,000 house price with an $80,000 down payment at a 6.7% interest rate for 30 years.

Option 2 differs from Option 1 in that the house price is 10% cheaper based on the most recent trend in prices. Since in Option 1, a person was able to put the $80,000 down payment, they should be able to afford that as well in Option 2. In Option 1, the monthly payment comes out at $1,765 while in Option 2, it is 20% higher at $2,109. However, this comparison makes two assumptions – 1) prices will not continue to drop, which is an unlikely assumption; and 2) throughout the duration of this mortgage, it would not be refinanced or financed via an adjustable rate mortgage from the beginning. If prices were to drop another 10%, the fixed mortgage payment will fall to $1,825 per month. Using an adjustable rate mortgage, which economists recommend, would result in both a lower starting interest rate and lower monthly mortgage payment in the near future due to the expected reduction of interest rates in the US over the next several years. To add another potential benefit, mortgage interest payments are tax deductible, which may further make the higher interest rate more economical.

Thus, just looking at the mortgage rate is simplifying the housing affordability problem too much. The housing issue can only be resolved by increases in housing supply, which is a fiscal policy issue rather than a monetary policy issue. Senator Raphael Warnock did, however, point out a way that higher interest rates can impact the supply of housing. Higher interest rates generally make it more expensive for businesses to operate as capital is more expensive. This could make it harder for home builders to undertake new projects. However, since house prices are close to all time highs, it is probably still very profitable for home builders to continue construction.

Conclusion

Economic issues are constantly talked about in a variety of settings. Simplifying them or misrepresenting them can be dangerous if it leads to bad policy decisions. Misattributing the housing affordability crisis to monetary policy rather than fiscal policy is one such issue. Similarly, it is for the government and fiscal policy to assist the long-term unemployed in finding jobs and not part of monetary policy.

Monetary policy is controlled by the Federal Reserve that is run by people that do generally take into account the various economic issues when making decisions. However, even the Federal Reserve is not infallible; inflation did get high, and the Federal Reserve’s potential focus on wages pushing inflation might not be justified. That is why the main contribution of economics is not specific policy prescriptions, but rather a general framework of how to think about issues and how these issues can intertwine with all elements of society. Only when seeing these issues from a wider perspective, can we tackle them with good policy.

If you enjoyed this post, please feel free to share it!

You may also find these past posts on inflation interesting:

Wages and Inflation (December 4, 2022) – to what extent do wages cause inflation?

Causes of Current Inflation (December 18, 2022) – what was behind the inflationary surge during the Covid pandemic?

Inflation and Expectations (March 1, 2023) – how do expectations affect Central Bank policy and what does recent research suggest about how to tackle elevated inflation?

Human capital consists of personal attributes that are of use to the production process, including education, know-how, skills, talent, and health.